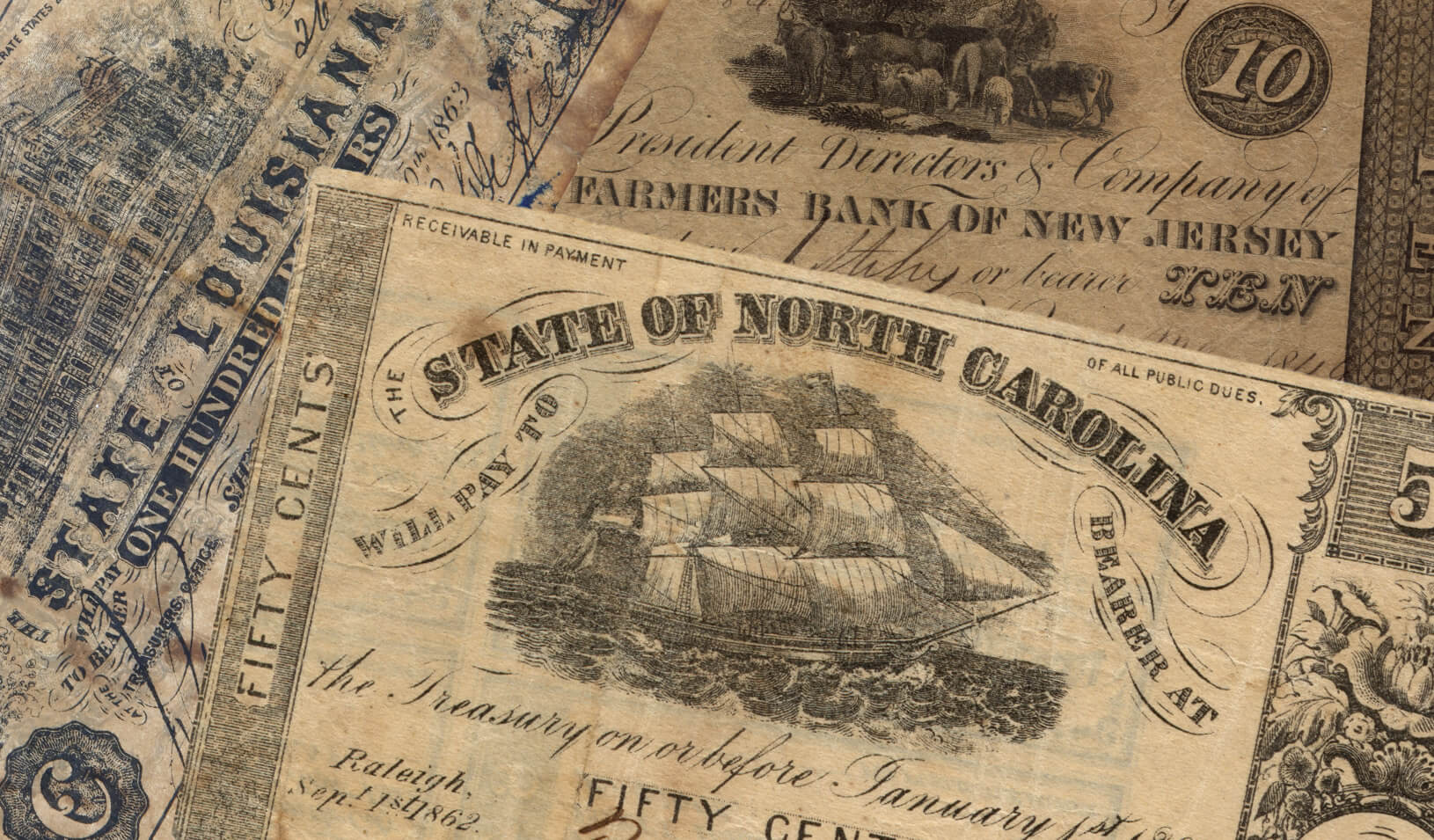

Workers’ aversion to financial risk contributes to income inequality. | Reuters/China Daily

As the income gap between rich and poor widens, there’s a growing suspicion that the game in our frantic modern economy is tilted against working people. The widely shared prosperity of the 1950s, when the American Dream seemed open to all, is beginning to look like a historical anomaly. Somewhere, no doubt, the author of Das Kapital is muttering through his great Victorian beard, “Ja, I told you so.”

Indeed, French economist Thomas Piketty caused a sensation in 2014 when he published a book titled Capital in the Twenty-First Century, updating Karl Marx’s claim that rising inequality is inherent to capitalism, because the capitalists — investors who supply financial capital to businesses in exchange for equity — take an ever-larger slice of the economic pie.

In other words, those who own the means of production — the factories and offices and machines and so on, which economists call “capital inputs” — get richer while working stiffs get, well, stiffed. And unlike Marx, Piketty had data: From 1970 to 2010, he showed, the share of national income (GDP) that went to owners of capital (in the form of profits) rose while labor’s share (wages and salaries) declined.

The common explanation for that trend is that U.S. companies have invested heavily in technology and automation — essentially replacing human workers in the production process with more and more capital. And industries that still require a lot of manual labor have outsourced much of their production to countries with lower wages.

But Hanno Lustig thought there might be more to it. A professor of finance at Stanford Graduate School of Business, he was used to thinking in terms of risk/return tradeoffs, and he knew that the amount of risk faced by firms had risen over the same period. If (as you’d expect) workers are more risk-averse than investors, he wondered, might that fact be contributing to the shift in income shares?

To find out, Lustig, along with Barney Hartman-Glaser of UCLA and Mindy Zhang of the University of Texas at Austin, built a theoretical model of the economy that incorporated business risk. When they set it in motion, the model yielded a surprising prediction: If risk was indeed a key factor, labor’s share of income at the average firm should have gone up, even as the aggregate share declined.

When the researchers analyzed real-world data, they were astonished to discover that the prediction was correct. “This is a very unexpected result,” Lustig says. “Nobody has approached this question on the level of the individual firm before. But if you look at the typical public company, labor’s share actually has increased over time.”

The Value of a Steady Paycheck

All companies face some economy-wide risk from business cycles and things like energy price shocks. But that’s a tiny fraction of the uncertainty that firms are exposed to, Lustig says. “Most of the risk is particular to a company or an industry.” It could be anything, like a supply problem or a new entrant or a competing innovation, that cuts into their margins. “Firm-specific risk is huge, and there’s much more of it now than there used to be.”

So at any given company, no one knows in advance how much money will actually be available to divvy up between investors and employees each year. But the suppliers of capital are much better able to cope with that uncertainty. “Equity owners have an advantage in bearing risk,” he says. “They can diversify by holding a portfolio of stocks. Labor income is usually tied to the performance of a single company.”

As a result, he says, “you’d expect workers to trade off some of their earning potential for income security” — a tacit understanding that their pay will remain constant even if the company’s fortunes decline. Of course, fixed wages and salaries are precisely what we see, and take for granted, in the real world. But there’s no reason it has to be that way.

“You can think of it as if companies are providing insurance to their employees,” Lustig says, with the insurance “premium” being implicitly deducted from each paycheck. “There’s a ton of evidence that firms really do try to insulate their employees from the ups and downs of business. And it makes sense.”

What happens, then, when firm-specific risk increases over time? “The insurance premiums go up,” Lustig says. And that shows up as stagnant wages that fail to keep pace with productivity. Multiply that across the entire economy, and labor’s share of national income shrinks.

But it doesn’t necessarily mean workers are worse off. “It looks like they’re being taken to the cleaners,” he says. “But remember, they benefit by being protected from market forces.” In a way, that income insurance is part of an employee’s compensation package, and it rises in value when the company’s prospects become more uncertain.

“I’m sympathetic to a lot of things Piketty says,” Lustig adds. “But he ignores all this idiosyncratic risk, and I think that’s too simplistic. At a minimum, this tells us we need to be cautious in linking the declining labor share to rising inequality.”

Risky Business

One can’t help wondering why firm-specific risk has gone up. The study doesn’t address that question, but in conversation, Lustig speculates that the rise of investment managers, ironically, may have played a role.

“Fifty years ago, it wasn’t that simple for an individual to diversify their stock portfolio — you had to go out and buy 30 stocks.” Transaction costs were substantial. So to attract capital, firms often tried to lower their own risk exposure by diversifying into unrelated businesses. It was the age of conglomerates.

The emergence of mutual funds made it easy for investors to diversify. As a result, Lustig says, companies may now be more inclined to pursue high-risk/high-reward strategies. “They know their shareholders can hedge that risk at virtually no cost.”

(Of course, if that’s true, a steadfast Marxist would point out that corporations are intentionally adopting business models that put workers at a disadvantage.)

Winner-Take-All

Whatever the cause, greater risk means greater disparity in outcomes. In this volatile environment, some firms are spectacularly successful and grow rapidly. Many others lose money and remain small — and many of those hang on for years, hoping to break through. (Under high uncertainty, the turnaround really might be just around the corner!)

As a result, when the researchers looked at the size distribution of all public companies, they found that it grew at both the upper and lower ends during this period: In a sense, inequality had increased among corporations.

And because wages are relatively constant, Lustig says, you’d expect that variance to be reflected in the return on equity. Struggling firms would still try to make payroll, with little left over in profit for investors, the contributors of capital. At the small number of immense, highly profitable firms — the Apples and Alphabets of the world — the bonanza would go almost entirely to investors.

In fact, when Lustig and his colleagues looked at the share of value added going to capital in each firm and plotted it against sales, they found exactly that: The bigger the company, the larger the capital share — and the lower the labor share. What’s more, he says, this is a new phenomenon: “In 1970 there was almost no relation between income shares and size. Forty years later there’s a strong relation, and the slope of that line is very steep.”

What this means, he says, is that “the declining labor share at the economy level is driven by the growth of large firms.” It’s a consequence of rising market concentration, which in turn has been driven by increased risk. “In our statistical analysis, we find that firm-specific risk accounts for a large share of the decline in labor income at the national level. I’d say probably more than half,” Lustig says.

And because of their size, these corporate giants dominate the national income figures, even though the typical firm falls closer to the other end of the spectrum. Hence that surprising empirical pattern of a declining aggregate labor share and an increasing average labor share.

“That divergence between aggregate and average shares is the signature of the risk-insurance effect,” Lustig says.

A New Framework

There’s no question that workers are taking home a smaller piece of the economic pie. Considering public companies as a whole, labor’s share of value added has declined from 60% in 1980 to 40% today — a stunning drop — with the difference going to Marx’s “capitalists.”

But as this seminal study shows, that’s not simply a result of exploitation by those with greater market power. There’s at least a tacit agreement, manifested in the customary arrangement of fixed wages, that prevents workers from sharing in the bounty from the most prosperous ventures.

“The owners of capital are bearing most of the risk in increasingly volatile markets,” Lustig says. That arrangement has value for workers that is not reflected in measures of labor income. Likewise uncounted are the losses by investors in companies that fail, which would lower net capital income.

“I don’t want to sound like an apologist for the status quo,” Lustig says. “If income inequality is worsening, that’s a serious concern and one we should address in public policy. But the role of risk in all of this has been ignored, so I don’t think we have an accurate picture of the problem at this point. I hope this study can be the beginning of a more nuanced discussion.”

For media inquiries, visit the Newsroom.