Federal Reserve Chair Jerome Powell has said he will refuse to resign if asked to do so by President Trump. | Reuters/Yuri Gripas

As the stock market racked up its worst year in a decade, President Donald Trump wasted no time in lashing out at the Federal Reserve. By raising interest rates, he complained, the Fed was “going crazy.” He called it the “only threat” to economic growth and said he was “not even a little bit happy” with his selection of Jerome Powell as Fed chair.

The war of words is far from over, and it breaches a protocol that both Republican and Democratic presidents have observed for decades.

But Darrell Duffie, the Dean Witter Distinguished Professor of Finance at Stanford Graduate School of Business, predicts that Trump is picking a fight he won’t win.

It’s not just that the Federal Reserve has cultivated a deeply enshrined political independence over the past half-century, says Duffie. It’s also that Fed officials know that their job becomes much harder if investors and the public even suspect that the central bank would yield to political pressure.

The Importance of Perceived Independence

“The Federal Reserve operates on the principle that it must maintain not only its actual independence but also the public perception of its independence,” Duffie says. “They know that every nudge of that perception away from independence is not good. As a result, they will be very cautious about lending any credibility to the idea that the Fed would follow short-term, politically motivated advice.”

At the moment, Duffie says, the Federal Reserve has enough public respect and institutional resilience to withstand Trump’s tirades. Indeed, markets plunged sharply after several news organizations reported that the president was looking into firing the Fed chair and then rebounded when top administration officials declared that Powell’s job was “100% safe.”

Interestingly, it was only after the White House retreat that Powell reassured markets that the Fed was “prepared to adjust policy quickly and flexibly” if the economic outlook were to change for the worse.

Base-Level Rhetoric

“My view is that the president is speaking to his political base and to his short-term political interests,” Duffie says. “So while his rhetoric may have some credibility with his political base, which is pretty hard-core, it has had absolutely no impact anywhere else from what I’ve seen.”

The danger, Duffie says, is that relentless browbeating could eventually undermine public confidence in the Federal Reserve and thus reduce its effectiveness.

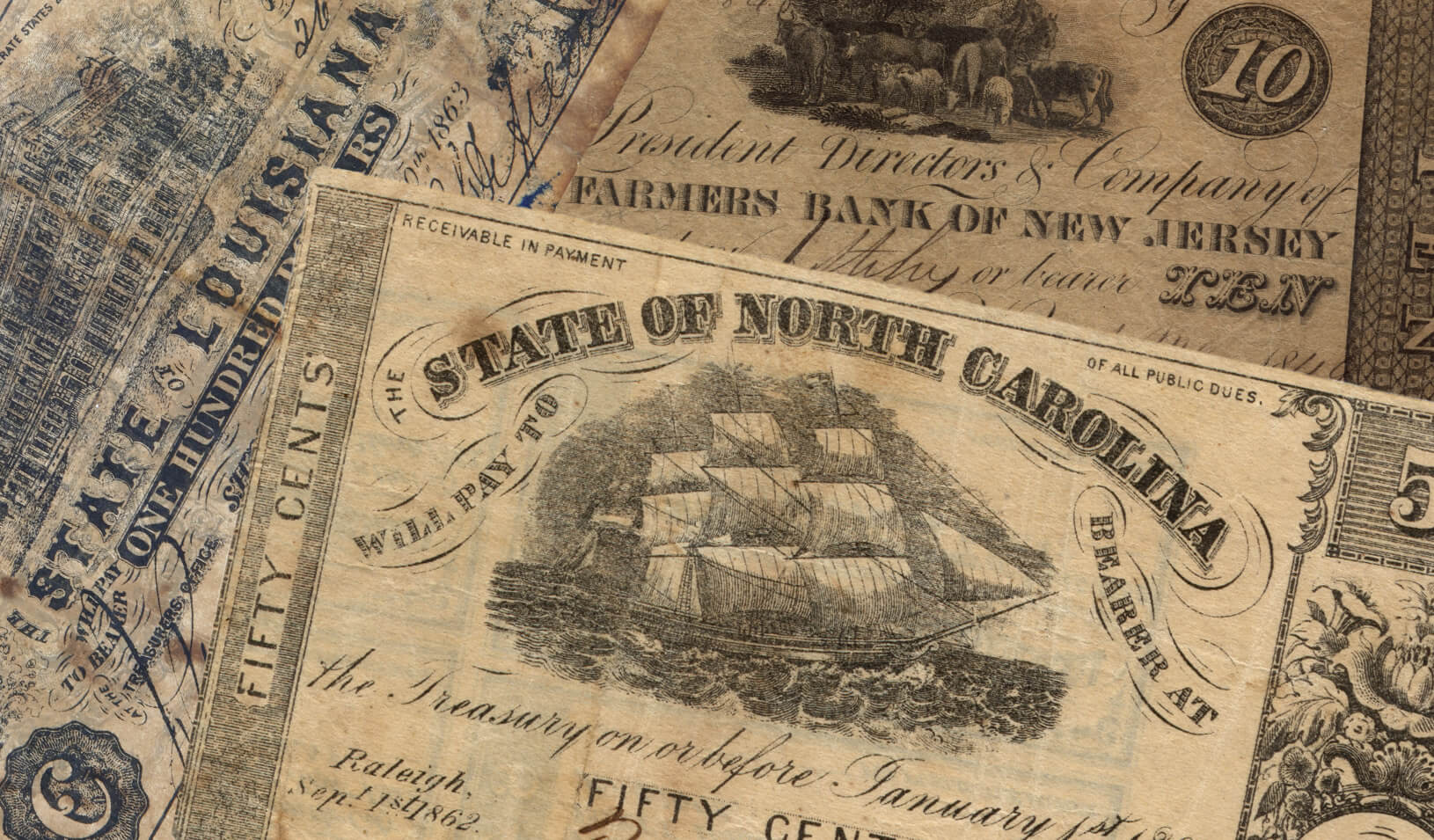

“Independence is like currency — it’s money in the bank,” Duffie says. “The Fed wants to keep a good stock of it on hand, and doesn’t want to use it up unnecessarily. Any time the Fed appears to succumb to political pressure — it would not, but even if it just appeared to succumb — a little bit of that currency would be used up.”

The challenge now is that Fed officials are engaged in the relatively unpopular process of raising interest rates, effectively tapping the brakes on economic growth, even though inflation remains very low.

It’s not a new challenge. Back in 1955, then-Fed chair William McChesney Martin famously quipped that his job was to take away the punch bowl just as the party starts to really warm up.

Duffie puts it another way: “As Wayne Gretzky used to say, you’re not trying to skate to where the puck is now — you’re going to where you think it’s going to be.”

Inflation is not a threat right now, he says, but it easily could be in 12 to 18 months, which is about how long it takes for inflationary pressures to result in significantly higher prices.

Beware the Inflationary Feedback Loop

That’s one reason why, for the past several decades, both Republican and Democratic presidents have carefully avoided commenting on Fed policy and deferred to its independence. The reasoning has been that even the appearance of political interference could undermine the Fed’s effectiveness — and could actually create an inflationary feedback loop.

If manufacturers and retailers suspect that the Fed would cave to political pressure and let inflation climb higher, they may start to raise prices in anticipation. And as the labor market tightens, workers will demand higher wages and companies will increasingly go along in order to keep workers from jumping to other firms.

“I have no doubt that Chairman Powell and the Fed as an institution are entirely aware of precisely those risks,” Duffie says. “That’s why, despite the interference from President Trump, I expect the Fed to guard its independence and to continue its focus on maintaining both stable prices and high employment.”

For media inquiries, visit the Newsroom.