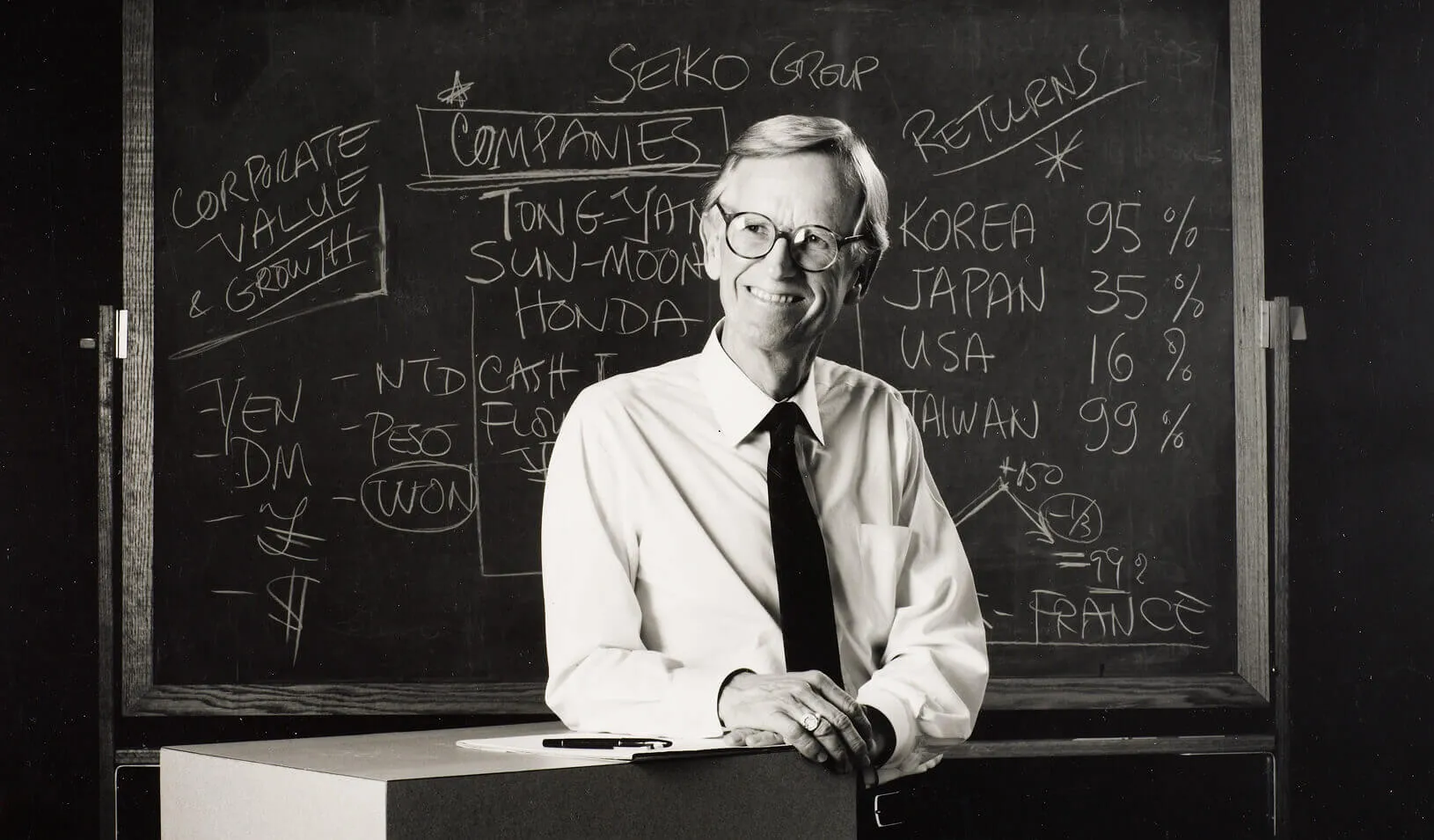

In 50 years of teaching, Jack McDonald missed only one class to be with his father when he died. | R.J. Muna

John G. “Jack” McDonald, the Stanford Investors Professor of Finance who taught over 10,000 MBA and Executive Education students over a remarkable 50-year career at Stanford Graduate School of Business, died Jan. 26 at Stanford Hospital in Palo Alto. He was 80 years old.

Known internationally for his work on investment in global equity markets, McDonald was renowned on campus for his intense devotion both to his students and the study of investing said Jonathan Levin, Philip H. Knight Professor and Dean of Stanford Graduate School of Business.

“He helped Stanford GSB graduates land jobs, start investment funds, and work through life transitions; he was a source of advice and wisdom,” Levin said. “His dedication to his teaching was breathtaking. Today, his students span the globe, and the achievements and contributions of Jack’s ‘Investment Family’ are a continuing legacy for Jack and for Stanford.”

Born in 1937 in Stockton, Calif., McDonald received his BS in engineering with honors from Stanford in 1960. He began his career as an engineer at Hewlett-Packard Company, and received his MBA at Stanford in 1962. He served as a lieutenant and platoon leader in the U.S. Army’s 25th Infantry Division, and then returned to Stanford, completing his PhD in 1967.

A Fulbright Scholar, McDonald taught briefly at the French business school L’Ecole des Hautes Etudes Commerciales (Ecole HEC) in Paris before joining the Stanford Business School as assistant professor of finance in 1968, beginning his five-decade run. He was promoted to full professor with tenure in 1974-1975. McDonald was a visiting professor at the University of Paris; Columbia University in New York City; and at Harvard Business School, and from 1989-1990 was the first professor to serve as vice chairman of the NASD/NASDAQ. He was the author of more than 30 articles published in academic and professional journals.

McDonald was awarded his first endowed professorship in 1978 by Dean Arjay Miller. In 1987, Dean Robert Jaedicke appointed him to the IBJ Professorship. Dean Bob Joss awarded him the Stanford Investors Professorship in 2004. That professorship will be renamed in McDonald’s honor, as will the residential center Highland Hall and The GSB Common, all of which were funded by McDonald’s friends and former students.

McDonald taught Stanford GSB’s first class on private equity, Private Equity Investing, as well as The Investment Seminar and other classes in the Stanford Executive Program. But his name is synonymous with Finance 321 – Investment Management and Entrepreneurial Finance.

“Jack’s class was the most sought-after class in preregistration, and had the longest waiting list of any class in the curriculum,” said George Parker, Dean Witter Distinguished Professor of Finance, Emeritus, who knew McDonald since they both arrived at Stanford GSB in 1962 as students. “I think he taught more students than any single faculty member in the history of Stanford GSB.”

McDonald taught fundamental investing, believing that markets are not always efficient, and that discrepancies occur. Those willing to examine the true worth of an enterprise and compare it to its market price, he taught, might be able to capture the gap in value.

“His approach was to figure out how companies worked – looking at their balance sheets, income statements, working capital, cash flow, all those things, and that’s how his students invest now,” said his wife, Melody, who graduated from Stanford Music Department’s doctoral program in French Baroque in 1975, and Harvard Business School’s MBA program in 1986. “Many students would come in who perhaps had not been in finance before, and he helped them think about investing, all aspects of it. I’ve gotten many notes from those saying he changed their lives.”

Students also flocked to Finance 321 for the guest speakers McDonald regularly brought in to inspire his students. Many were successful former students at different points in their careers, who would share their victories, failures, enthusiasm, and resilience with students.

“Forty alumni from literally all over the world – Asia, Brazil, New York – would show up to teach in his class every year,” said finance lecturer Stuart Klein (MBA/JD ’83), a former student of McDonald’s who worked with his mentor for 25 years. “These were busy people who could have spent their time elsewhere but who thought so highly of him and his work that they made it a priority to come to teach these students.”

Among the speakers were investing luminaries Charlie Munger, Philip Fisher, and, for more than 20 years, his friend, Berkshire Hathaway Chairman Warren Buffett.

“I’ve never in the past 40-plus years met a Stanford MBA who didn’t regard Jack as a giant in teaching,” Buffett said. “No one who took his course ever forgot it, and they loved Jack.”

The first speaker each year was Carter McClelland (MBA ’73), chairman of Union Square Advisors and a former student of McDonald’s. McClelland presented the course’s foundation case on Bridge Communications, which he and McDonald had written together in 1985.

“We taught it together for 32 consecutive years, last teaching it in September 2017,” McClelland said. “It was the case that gave the students the valuation tools to then proceed through the course, and develop insight on companies and skills at making investment decisions.

“Jack’s class, and Jack himself, certainly influenced my decision to work in the world of finance,” McClelland added. “He was humble, smart, witty, and personable. His students adored him, and learned tons about the world of investing and finance that they could successfully carry into the world post their two years at Stanford.”

With Warren Buffett, center, after class at Stanford GSB in 2002. In recent years Melody McDonald helped her husband with the physical demands of teaching his classes. | Courtesy of Melody McDonald

McDonald learned every student’s name quickly, was interested in their background, and passionately and painstakingly cultivated an extensive, worldwide network of former students he called his ‘Investors’ Family.’

“As you hit various milestones along your career, you could reach out to people who were 5, 10, 20 years ahead of you and ask for help. You could call Jack. He’d always be able to say “Call this person,’ and they’d generously share advice and insight with you,” said finance lecturer John Hurley (MBA ’93), who worked with McDonald. “He was more than a teacher; he was a real mentor who didn’t just touch students’ lives, but shaped them. As students would pass through class, they’d become part of Jack McDonald’s family, with an obligation to help one another. Succeeding generations of students would help the next along.”

That help often came directly from McDonald, said Klein. “He’d introduce them to partners and sources of capital, and when they were starting a new fund, as a show of support he would become limited partner number one.”

McDonald’s networking skills were an extension of his innate interest in the lives of others, said his son, Tom. “He always took a deep, fundamental interest in people and their stories, and always remembered every last detail,” he said. “In an hour he could find out everything about a person. And that was his approach to business, and why everyone felt he was their best friend.”

McDonald was interested in and supported organizations working to alleviate homelessness and assist the developmentally disabled. He enjoyed golf, walking and hiking, and spending time in his yard communing with his small grove of 20 tall redwood trees, which he loved.

“We like to joke about them being a symbol of a good value investment,” said his son. “They were only 5 feet tall when we bought them.”

Jack McDonald is survived by his wife, Melody; sons Tom and Peter; brother Donald; daughter-in-law Nara; grandchildren Emma and Calum; and sister-in-law Nancy Larson. Stanford GSB will hold a memorial service on campus later this year.

– Beth Jensen

For media inquiries, visit the Newsroom.