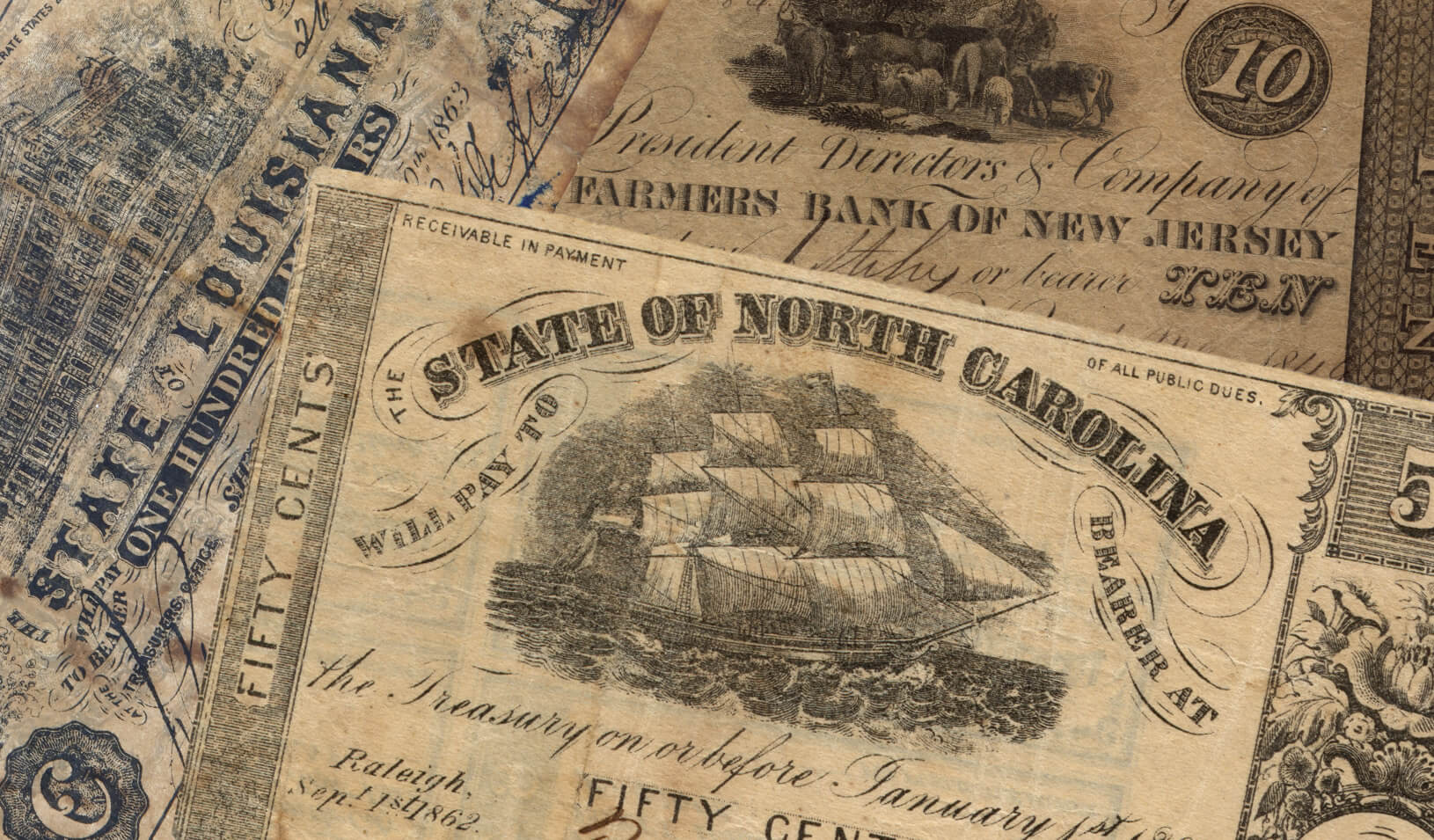

The European Union plunged into turmoil after most members adopted the euro as a common currency | Flickr photo by Images_of_Money

Economic theory holds that freer movement of capital, goods, and people is generally a good thing. So why did the European Union plunge into turmoil, despite reducing barriers in all three areas, and after most members adopted the euro as a common currency?

Average wages grew faster than worker productivity in southern European countries during a decade when investors were willing to accept similar interest rates across the eurozone | Stanford GSB Economics Professor Chad Jones, using data from the Federal Reserve Economic Data database

We asked two scholars with different vantage points. Michael Spence is a Nobel prize-winning scholar on global growth and former dean of Stanford Graduate School of Business. Keith Hennessey, a former director of the National Economic Council under President George W. Bush, is now a lecturer at the business school. In separate interviews, both point to a striking divergence after the euro: Productivity gaps widened rather than narrowed between northern powerhouses such as Germany and “periphery” countries such as Greece. Both scholars warn that those gaps were embedded in a whole gamut of policies that affect national competitiveness, from fiscal policy to market regulation. Both worry that policy makers have yet to fully absorb the lesson.

The EU lowered many barriers, and the results were generally positive. So what went wrong?

Michael Spence: The short answer is this: When the euro was introduced, it came with a central bank called the European Central Bank. Markets incorrectly assumed that the sovereign (government) debt was backed by the full faith and credit of the eurozone as a group. In other words, markets treated eurozone sovereign debt as equally safe, whether it was issued by Greece or Germany. That wasn’t true, but it took 10 years to find out. In the meantime, countries that were facing economic challenges because of productivity problems used low-cost debt and government spending to increase employment and growth.

What should have happened is that, as the debt rose, the ratings of those governments should have declined, and their interest rates should have gone up. That did not happen, however, until the system came unraveled by the global financial crisis that emanated from the United States.

One might now conclude that everything will eventually stabilize and be fine, because investors have now abandoned the flawed assumption that sovereign debt is backed by the whole eurozone.

Unfortunately, that is not the end of the story.

Government policies can lead to huge differences in the productivity and competitiveness of national economies. One way [to effect change in national economies] is through fiscal discipline, but there are many others: the nature of their tax systems, investment in infrastructure and human capital, and the degree of market liberalization and flexibility.

The problem is that virtually all of these policies are decentralized in Europe. In the old Europe, that was OK, because adjustments were made through shifts in the value of currencies and through inflation. But in the new Europe, the common currency has eliminated those options.

What you are now seeing in the euro crisis is a forced convergence in productivity through a painful process of deflation. But many countries that have trouble, like Italy, are still not carrying out the reforms needed to close the productivity gap. Even now, there is a feeling that with fiscal discipline or a fiscal union, everything will be fine. But that will not solve the entire problem. There will remain the potential for policies that cause divergences in growth, and countries will still have only limited adjustment mechanisms.

I don’t think anyone appreciated how important the exchange rate was as a form of adjustment. It not only adjusts fairly automatically to shifts in relative productivity. It also distributes the burden of the adjustment without the need for divisive, political-fraught discussions. When a currency declines in value, everything purchased from outside the country becomes more expensive for everyone.

So, to go back to the general subject, the removal of barriers is a good thing at some basic level, but only if it occurs within structures and systems that make sense, and where things are not out of balance. Let me conclude with another example. In developing countries like China, opening the capital account to capital inflows and outflows gradually, and in parallel with development in the financial sector, is generally a good thing. But the caveats — that it be gradual and in parallel with the financial sector — are important. Doing it overnight is a very bad idea. It leads to volatility and often crises. Developing countries have learned these kinds of lessons over time, and they apply them in a pragmatic and somewhat experimental way.

Keith Hennessey: The reality is that you still have largely balkanized, national economies, not only in fiscal policy but also in regulatory and labor policies. Yes, you have a common currency. But you still have radically different levels of productivity in, say, Germany versus Portugal. If those barriers were really gone, and you had flexible labor and product markets, you would expect to see productivity in different countries start to converge.

In some of these countries, fiscal policy has, in effect, relieved the pressure on governments to start that equalization of productivity. Governments were spending very liberally to create large welfare states, which protected workers from the effects of competition.

If I don’t have to worry about getting laid off, because my home country has protected me from that, or because my government will provide me with generous benefits if I do lose my job, then there is less pressure on me to pick up and move north. There is also less pressure on my employer to adjust.

Will the austerity measures now being imposed be effective?

Keith Hennessey: In short term, I don’t know. In the long run, I’m skeptical. Politicians of all stripes and in all countries are expert at exploiting moral hazard. When you have a backstop from the European Central Bank, elected officials in those countries don’t have to make changes as rapidly as they would otherwise. So, while the ECB has relieved short-term pressure, I think it is a bad thing in the medium and long term, because it makes it easier for various constituencies to dig in their heels.

Haven’t the crisis countries already gone through brutal fiscal reform and belt-tightening?

Keith Hennessey: They’ve certainly gone through some of that reform, but they’re judging it relative to where it was before and by the political pain that’s generated by those changes. By contrast, the markets are judging it by how far you still have to go. Just because they have made politically difficult decisions doesn’t mean they have done enough to convince markets that lenders will get their money back.

As long as fiscal and economic structural problems are unresolved, and as long as you have uncompetitive productivity levels, economic pressures will continue to pull the eurozone apart. But diplomatic pressures are pushing to hold it together, almost at all costs. There are tremendous diplomatic and historical reasons why leaders from across Europe want to hold the European Union together — two world wars. But the economic forces are pulling in the opposite direction.

Which forces, the economic or the political and historical ones, are likely to prevail?

Keith Hennessey: I don’t know. My general view is that, in the short run, politics can trump economics. But if the trend lines are wrong, then in the long run the math will win.

For media inquiries, visit the Newsroom.